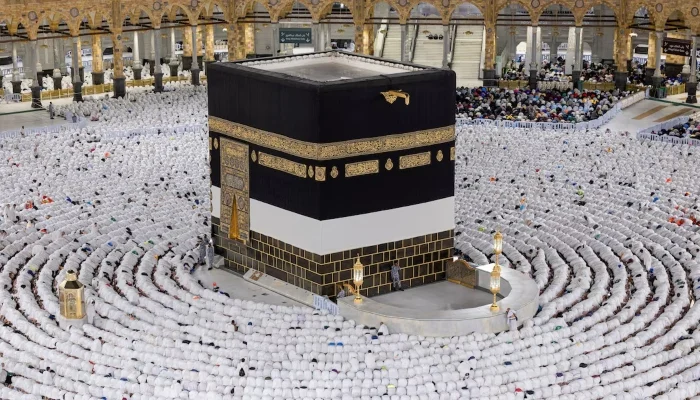

As the Financial Markets Forum is currently taking place in Riyadh, Dr. Mohammed Makni, Professor of Finance and Investment at Imam University, shared valuable insights into Saudi Arabia’s financial market developments,

emphasizing the importance of the Nomu-Parallel Market, the growth potential of listed companies, and strategies to enhance the insurance sector and debt markets.

The Nomu-Parallel Market has seen significant growth since its launch seven years ago, initially featuring only 7 to 9 companies. Today, it boasts over 106 listed companies with a market capitalization of approximately 60 billion SAR.

This expansion reflects Saudi Arabia’s strategic efforts in developing its financial markets, supported by the Capital Market Authority’s (CMA) 2024-2026 strategic plan.

The plan focuses on increasing listings and encouraging small and medium-sized enterprises (SMEs) to enhance their governance practices, ultimately driving profitability and attracting investments.

In recent years, Saudi Arabia’s financial market has undergone a remarkable transformation, improving regulatory and technological frameworks, opening foreign investment channels, and achieving inclusion in global emerging market indices.

Looking ahead, the Kingdom’s ambition extends beyond emerging markets, aiming to secure a position within advanced market indices, a goal that aligns with ongoing market reforms and developments.

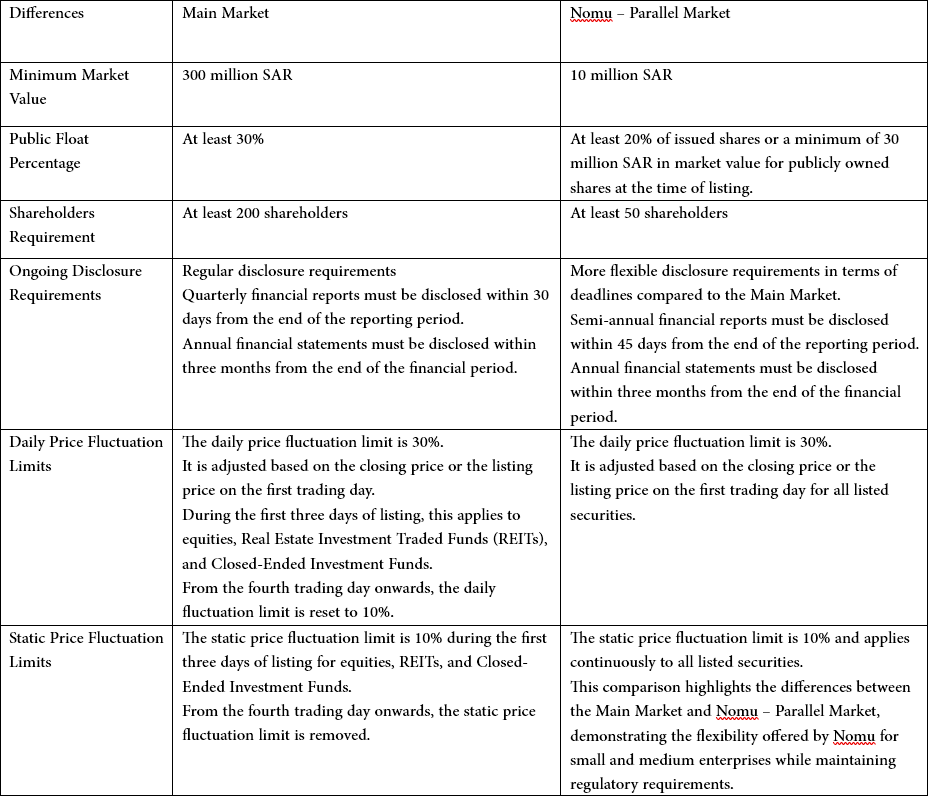

Key Differences Between the Main Market & Nomu – Parallel Market

How Does the Parallel Market Benefit Companies and Investors?

By supporting SMEs, the Nomu-Parallel Market plays a crucial role in economic growth, enabling businesses to expand and secure necessary funding.

Simultaneously, it offers investors new opportunities to diversify their portfolios.

Below is a summary of the key advantages for both companies and investors in the parallel market:

Benefits for Companies:

Access to capital: SMEs can list their shares in the Nomu-Parallel Market to attract investments and drive growth.

Flexible listing requirements: Compared to the main market, the parallel market has less stringent listing criteria, making it more accessible to SMEs.

Enhanced credibility and investment opportunities: Listing on Nomu boosts a company’s reputation and market presence, unlocking potential investment opportunities.

Gateway to the main market: Companies can use Nomu as a stepping stone to eventually transition to the main market, allowing them to enhance performance and align with financial market requirements.

Benefits for Investors:

Investment in promising SMEs: The parallel market provides investors with early access to SMEs with high-growth potential.

Portfolio diversification: Investors can diversify their portfolios by exploring opportunities beyond the main market.

Profit potential before main market listing: Investors can capitalize on price movements before a company officially transitions to the main market.

Insight into stock performance trends: The Nomu-Parallel Market serves as a key indicator of how a stock may perform post-listing in the main market, helping investors make informed trading decisions.

Pre-market price advantage: Investors can assess demand for a company’s stock in the Nomu-Parallel Market before its official main market listing.

As Saudi Arabia continues its financial market evolution, the Nomu-Parallel Market remains a pivotal platform for SME growth and investor engagement, further strengthening the Kingdom’s position as a global financial hub.

See More: Saudi Low-Cost Carrier Flynas to Receive Over 100 Airbus Aircraft by 2030