By Abeer Abdalla | The Saudi Times

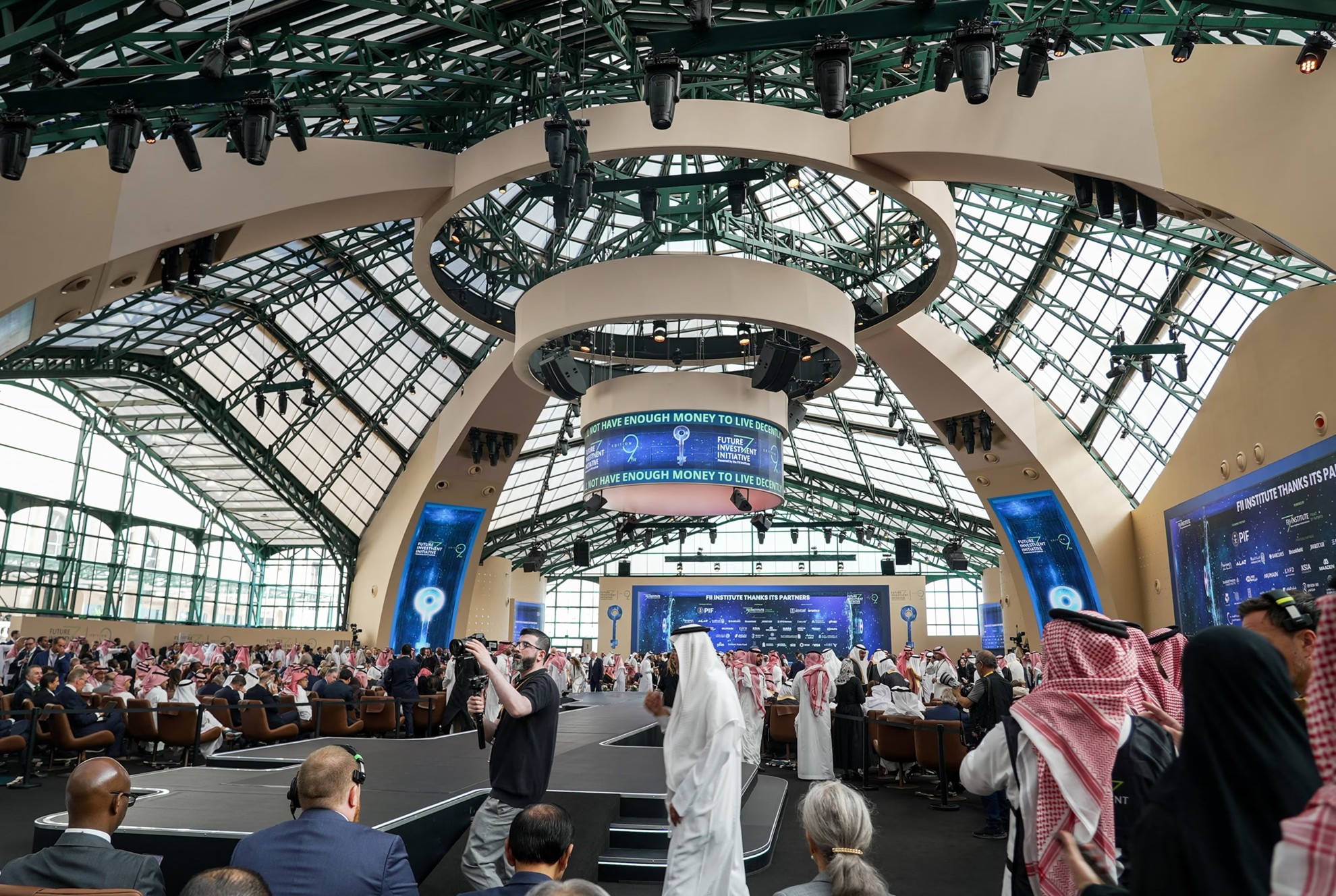

The closing moments of FII 2025 marked a turning point. $250 billion in deals were sealed at the event, a staggering figure that eclipses the annual foreign direct investment of several nations. Saudi Arabia has stopped preparing for the future. It’s shaping its direction. This ninth FII was designed as a real-time evaluation of economic influence. Saudi Arabia redefined success by establishing new business metrics.

Yasir Al-Rumayyan, governor of the Public Investment Fund, didn’t open with superlatives. He opened with a scoreboard: nearly $250 billion in investment deals sealed through FII since its inception. This impressive figure is even more striking when compared with total foreign direct investment into the MENA region last year, underscoring the monumental scale of FII’s achievements. These investments aim to bring tangible benefits, including the creation of nearly 100,000 new jobs, significant cost savings through technological innovations, and a boost in infrastructure that enhances everyday life for citizens. What followed wasn’t just rhetoric; it was a carefully coordinated sequence of decisions showcasing a state demonstrating that transformation isn’t left to chance but is systematically planned and executed.

From Diversification to Design

FII 2025 revealed PIF’s new focus: six ecosystems; tourism, advanced manufacturing, logistics, urban development, clean energy, and NEOM; each selected for its role in boosting the others, creating a synergy where advancements in one area directly benefit and scale progress in the rest, forming pillars of Saudi progress designed for global relevance.

A defining moment: Investment Minister Khalid Al-Falih urged PIF to yield to private leadership. This marked the transition from state-driven proof-of-concept to private-sector acceleration, opening new opportunities for international investors.

Foreign investors must now assess risks and alliances carefully, but the door is open to deeper international collaboration and innovation. Recognizing the complexities of foreign investments, Saudi Arabia is actively addressing key risks to further enhance transparency and build investor confidence. Regulatory risks are mitigated through reforms aimed at creating a more predictable and stable legal environment for businesses. Political stability is being reinforced by strengthening diplomatic ties and fostering regional alliances, ensuring a secure investment landscape. Operational challenges, such as logistical and infrastructural barriers, are being tackled with significant investments in transport and digital infrastructure, ensuring seamless operations for new and existing businesses.

The Year the Deals Grew Teeth

FII 2025’s announcements reshape markets and partnerships:

- The UK–KSA axis: $8.6 billion in trade deals and a $6.8 billion PIF partnership signal Western capital’s realignment toward Saudi Arabia.

- Aramco’s $11 billion Jafurah deal showcased monetizing infrastructure at global sophistication levels.

- The HUMAIN-FII Institute partnership will deliver the world’s first Arabic-language AI foundation model, claiming a stake in linguistic AI.

Global leaders gathered not just to speculate, but to align. Riyadh is now a center of gravity.

The Philosophy Beneath the Numbers

FII 2025 is about conviction, not just capital. Saudi Arabia now looks inward for momentum, echoing the transformation of Japan in the 1960s: local innovation as global leverage. To deepen this analogy, consider the R&D intensity: in the 1960s, Japan increased its R&D expenditure to levels that propelled its economic growth, with R&D spending of nearly 3% of its GDP by the late 1960s. Similarly, Saudi Arabia is channeling increased investment into R&D, aiming to achieve a comparable transformation with current figures indicating a rise to 2.5% of GDP, showcasing a commitment to innovation-driven growth. Globally, the average R&D spending among G20 nations is around 2.5% of GDP, positioning Saudi Arabia as a competitive force in innovation. In comparison, emerging markets like Brazil and India spend about 1-1.5% on R&D, highlighting Saudi’s aggressive push toward an innovation-centric economy.

This new phase is about belief: that the Saudi private sector, empowered by confidence, can outperform imported expertise. These five developments guide a transformative narrative: First comes the sovereign vision, where aspirations turn into strategic blueprints. This vision then attracts global capital, fueling the ambitious designs laid out by the Kingdom. With capital secured, the next stage is private execution, where the private sector takes the lead in bringing these plans to life. Technology becomes the enabler, driving innovation and creating new avenues for growth. Finally, the export of successful models, where Saudi Arabia shares its developed systems with the world, completing the post-oil blueprint.

Prosperity is now programmable.

Saudi Arabia’s success will be measured not by capital attracted, but by systems exported: urban, digital, and philosophical models that shape global standards. To keep up, other nations might look to replicate Saudi systems through policy mimicry, adopting successful regulatory and strategic frameworks. Additionally, international collaboration, such as the establishment of joint research and development hubs, could foster shared innovation and technological advancements, inviting nations to not only compete but to partner in this evolving global landscape. International investors and companies can engage in these collaborations by forming strategic alliances with Saudi firms, participating in the new research hubs, and contributing to ongoing infrastructure development. By doing so, they gain access to cutting-edge innovations and help reshape global standards, while also benefiting from a predictably stable investment environment fostered by Saudi Arabia’s strategic reforms.

The next FII will focus on execution: renewables, Arabic AI, and private-sector deals. Investors should keep an eye out for potential announcements on groundbreaking pilot projects and any shifts in regulatory frameworks that could impact strategic sectors. These developments could offer new opportunities and inform their future strategies. This is Version 2030: a living operating system, always updating and expanding. The world is watching Saudi Arabia convert ambition into architecture and oil wealth into data sovereignty.And in that transformation lies a quiet reversal: For decades, the world wondered if Saudi Arabia could keep up. Now, the question is: can the world keep up with Saudi Arabia? The story of FII 2025: the future is now being scripted in Arabic, in code, and in Riyadh—and the world must keep pace.